Housing is the biggest expense for many Americans, accounting for more than 30 percent of a household’s yearly expenditures, according to the Bureau of Labor Statistics. But housing costs can vary greatly, depending on where you live — and whether you’re a renter or owner.

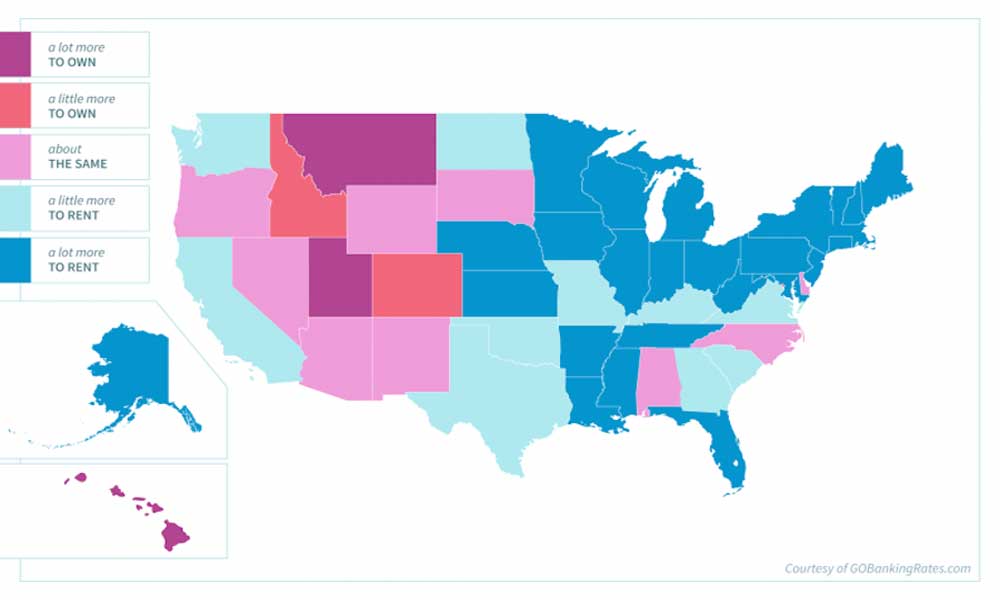

To find out where your housing dollar will go the furthest, GOBankingRates surveyed the cost of renting versus owning a home in all 50 states and the District of Columbia. The study found it’s more expensive to own a home in only eight states and the District of Columbia, with renting the more expensive option in 42 states.

With rents so high, though, it can be difficult to save up for a down payment and make the jump to homeownership, she said. If you’re considering becoming a homeowner, scroll down to find out if you should own or rent a home in your state.

Wyoming

Renting vs. buying a home in Wyoming:

Monthly rent in Wyoming: $1,100

Monthly mortgage in Wyoming: $1,199

How much do you need to live comfortably in Wyoming? If you want to rent or buy a home, make sure you get a job that pays enough to cover a monthly rent or mortgage of around $1,000. But the good news: Wyoming might start experiencing declining home prices, according to an Arch Mortgage Insurance Company report released in April.

Vermont

Renting vs. buying a home in Vermont:

Monthly rent in Vermont: $1,500

Monthly mortgage in Vermont: $1,226

One of the best states for first-time homebuyers, Vermont’s homes have become more affordable over the past year. The median sale price has dropped about 4 percent, according to the Vermont Realtors May 2016 report.

Only 13 percent of Vermont homeowners spend more than 50 percent of their income on housing, according to the Vermont Housing Finance Agency. However, 28 percent of renters spend half of their income or more on housing.

District of Columbia

Renting vs. buying a home in DC:

Monthly rent in the District of Columbia: $2,575

Monthly mortgage in the District of Columbia: $2,719

Even though it’s cheaper to rent instead of buy in the nation’s capital, the National Association of Realtors identified Washington, D.C., as one of the top markets for aspiring millennials who want to buy a house. That’s because millennials’ higher income levels are making it easier to afford a home.

Alaska

Renting vs. buying a home Alaska:

Monthly rent in Alaska: $1,690

Monthly mortgage in Alaska: $1,356

Rent in Alaska is higher than the U.S. median rent of $1,407, according to Zillow. Although home values have been rising, too, it’s still cheaper to own a house than rent one. Home prices have stayed steady even though the state’s economy — which depends heavily on the oil industry — is in a recession due to the low energy prices, according to the Arch Mortgage Insurance Company report.

North Dakota

Renting vs. buying a home in North Dakota:

Monthly rent in North Dakota: $1,250

Monthly mortgage in North Dakota: $1,144

Owning a home in North Dakota is less expensive than renting — and it might become even more so. The state’s home prices are overvalued by an estimated 22 percent because the state’s oil fracking boom drove up prices, according to the Arch Mortgage Insurance Company report.

South Dakota

Renting vs. buying a home in South Dakota:

Monthly rent in South Dakota: $1,100

Monthly mortgage in South Dakota: $1,033

Although home prices have risen by about 6 percent in South Dakota over the past year, according to Zillow data, it’s still cheaper to own a home than rent. However, even renting is more affordable in South Dakota than in many parts of the nation — considering the median rent in the U.S. is $1,407, according to Zillow.

Delaware

Renting vs. buying a home in Delaware:

Monthly rent in Delaware: $1,300

Monthly mortgage in Delaware: $1,375

Delaware’s housing market is rebounding as retirees move to the state and families move from rentals to homes, the state’s The News Journal newspaper reported in January. The median home list price has risen about 3.8 percent over the past year, according to Zillow data. As a result, it’s more expensive to buy a home than to rent a home in this state.

Montana

Renting vs. buying a home in Montana:

Monthly rent in Montana: $1,100

Monthly mortgage in Montana: $1,348

Rising home prices in Montana have made the cost of owning a home more expensive. The median home list price in Montana has increased just 1.7 percent over the past year, but it’s climbed 7.5 percent from May 2014 to May 2016, according to Zillow data.

Rhode Island

Renting vs. buying a home in Rhode Island:

Monthly rent in Rhode Island: $1,750

Monthly mortgage in Rhode Island: $1,416

Consumers are taking advantage of low interest rates to buy homes in Rhode Island. Single-family home sales increased 19 percent from May 2015 to May 2016, according to the Rhode Island Association of Realtors. The median sale price also has risen 5 percent. Despite the strong real estate market, it’s still less expensive to buy a home in Rhode Island than to rent a home.

Maine

Renting vs. buying a home in Maine:

Monthly rent in Maine: $1,500

Monthly mortgage in Maine: $1,104

Single-family existing home sales in Maine have risen a whopping 25 percent in May over the past year, but prices have risen just 2.84 percent, according to a June report from the Maine Association of Realtors.

New Hampshire

Renting vs. buying a home in New Hampshire:

Monthly rent in New Hampshire: $1,475

Monthly mortgage in New Hampshire: $1,240

The New Hampshire market has been tight for renters, with rents rising as vacancy rates have been dropping, according to a February report by RealtyTrac. Renters who want to find affordable options in a tight market will likely have to make concessions, Gudell said.

Hawaii

Renting vs. buying a home in Hawaii:

Monthly rent in Hawaii: $2,347

Monthly mortgage in Hawaii: $2,862

The supply of houses hasn’t been able to keep pace with population growth in Hawaii, pushing prices up, according to the Hawaii Department of Business, Economic Development and Tourism. In fact, Hawaii has the highest median home list price — $577,499.50 — in the nation.

Although rent prices fell slightly from April to May, according to Zillow, the market still is less friendly to buyers than renters. And, Honolulu has the second-highest home price-to-rent ratio in the U.S., which means it is cheaper to rent than buy, according to SmartAsset.com.

Idaho

Renting vs. buying a home in Idaho:

Monthly rent in Idaho: $995

Monthly mortgage in Idaho: $1,199

Home prices have soared more than 23 percent over the past two years in Idaho, according to Zillow data. The average list price jumped from around $190,000 in May 2014 to $234,900 in May 2016.

West Virginia

Renting vs. buying a home in West Virginia:

Monthly rent in West Virginia: $1,098

Monthly mortgage in West Virginia: $832

Although the median home list price has risen 6 percent since the beginning of the year, according to Zillow data, it’s still cheaper to own than rent in West Virginia. However, home prices in West Virginia are expected to fall, according to the Arch Mortgage Insurance Company report.

Nebraska

Renting vs. buying a home in Nebraska:

Monthly rent in Nebraska: $1,200

Monthly mortgage in Nebraska: $884

It’s still less expensive to own than rent in Nebraska, although the median rent price in Nebraska has hardly budged over the past year while the median home price has climbed 5.8 percent, based on Zillow data.

New Mexico

Renting vs. buying a home in New Mexico:

Monthly rent in New Mexico: $1,125

Monthly mortgage in New Mexico: $1,043

The median home list price of $215,000 in New Mexico has held steady for nearly a year, according to Zillow data. Although the median rent price also hasn’t risen over the past year, either, it’s still slightly more expensive to rent than own in this state.

Nevada

Renting vs. buying a home in Nevada:

Monthly rent in Nevada: $1,275

Monthly mortgage in Nevada: $1,196

The median rent in Nevada has risen 6.25 percent from $1,200 in May 2015 to $1,275 in May 2016, according to Zillow data. In fact, Reno is among the top 10 U.S. cities with the fastest-growing rents, up 6.5 percent since June 2015, according to the July 2016 National Apartment List Rent Report. Rising rents in the state make renting a more expensive option than buying a home.

Kansas

Renting vs. buying a home in Kansas:

Monthly rent in Kansas: $1,150

Monthly mortgage in Kansas: $836

The monthly mortgage on a home with a median list price of $159,900 is $314 less than the median monthly rent in Kansas, making home buying a better prospect than renting in this Midwestern state.

However, home sales have been slower in Kansas compared to the rest of the country. Sales in Kansas rose by 1.3 percent in May 2016 compared with the same period last year, but home sales on a national level rose 4.5 percent, according to the Kansas Association of Realtors.

Arkansas

Renting vs. buying a home in Arkansas:

Monthly rent in Arkansas: $1,050

Monthly mortgage in Arkansas: $769

The monthly mortgage on a home with a median list price of $155,000 is $281 less than the median monthly rent in Arkansas. The median list price in this state has increased just 1.9 percent from May 2015 to May 2016, according to Zillow data.

Mississippi

Renting vs. buying a home in Mississippi:

Monthly rent in Mississippi: $1,100

Monthly mortgage in Mississippi: $791

The median monthly rent is $309 higher than the monthly mortgage on a home with a median list price of $160,000 in this Southern state. Although it’s more expensive to rent than own in Mississippi, the median rent here is still below the national median of $1,407.

Utah

Renting vs. buying a home in Utah:

Monthly rent in Utah: $1,275

Monthly mortgage in Utah: $1,517

Zillow named two Utah cities — Salt Lake City and nearby Ogden — in its top 10 hottest housing markets for 2016 list. Statewide, the median home list price has risen about 20 percent over the past two years, from $249,000 in May 2014 to $299,000 in May 2016, according to Zillow data.

Iowa

Renting vs. buying a home in Iowa:

Monthly rent in Iowa: $1,095

Monthly mortgage in Iowa: $836

Home buying has been on the rise in this state where owning is less expensive than renting. The number of homes sold rose 5.3 percent in April 2016 from the same period a year ago, according to the Iowa Association of Realtors.

Connecticut

Renting vs. buying a home in Connecticut:

Monthly rent in Connecticut: $1,700

Monthly mortgage in Connecticut: $1,486

Although home sales have been booming in Connecticut, home prices have not. Sales of single-family homes rose 17.28 percent year over year, according to Berkshire Hathaway HomeServices New England Properties’ Second Quarter 2016 Connecticut Market Report. Yet, the average price dropped 5.7 percent, which is good news for prospective buyers.

Oklahoma

Renting vs. buying a home in Oklahoma:

Monthly rent in Oklahoma: $1,050

Monthly mortgage in Oklahoma: $867

Low home prices make owning less expensive than renting in Oklahoma — and prices might get even lower, according to the Arch Mortgage Insurance Company report.

Oregon

Renting vs. buying a home in Oregon:

Monthly rent in Oregon: $1,550

Monthly mortgage in Oregon: $1,562

Buying a home is becoming more expensive in Oregon, as increased demand from people moving to the state drives up home prices, CNBC reported in January. Portland was named one of the top 10 hottest housing markets for 2016, according to Zillow. And over the past year, home values have increased 14.8 percent — the biggest increase among the 50 largest metro areas, said Gudell.

In a hot housing market such as Oregon, Gudell recommends avoiding shopping for a home during the height of the home sale season to lower the chance of getting into bidding wars with other buyers.

Kentucky

Renting vs. buying a home in Kentucky:

Monthly rent in Kentucky: $1,000

Monthly mortgage in Kentucky: $849

Statewide, the median rent in Kentucky is $151 higher than the monthly mortgage on a home with a median list price of $161,900. Kentucky’s housing market has been strong, with a record number of homes sold in 2015, according to the Kentucky Association of Realtors.

Louisiana

Renting vs. buying a home in Louisiana:

Monthly rent in Louisiana: $1,250

Monthly mortgage in Louisiana: $1,022

Buying a home in Louisiana is slightly less expensive than renting and could become even more affordable. Home prices are at risk of dropping, according to the Arch Mortgage Insurance Company report.

Alabama

Renting vs. buying a home in Alabama:

Monthly rent in Alabama: $950

Monthly mortgage in Alabama: $859

Although Alabama has the lowest median monthly rent on our list — along with Missouri — mortgage costs are even lower. Home sale prices have risen only slightly, even though supply has dropped but demand has increased, as evidenced by an 11 percent increase in home sales in May 2016 over May 2015, according to the Alabama Center for Real Estate.

South Carolina

Renting vs. buying a home in South Carolina:

Monthly rent in South Carolina: $1,250

Monthly mortgage in South Carolina: $1,121

The median rent in South Carolina is still higher than the median monthly mortgage cost, despite a stronger housing market. The state’s real estate market had its best year in 2015 since the end of the Great Recession in 2009, according to the South Carolina Realtors’ annual report.

Charleston is listed as one of the National Association of Realtors’ best home purchase markets for millennials. The household income and homeownership rates among millennials who’ve moved to this city recently are higher than the national average.

Colorado

Renting vs. buying a home in Colorado:

Monthly rent in Colorado: $1,700

Monthly mortgage in Colorado: $1,837

Owning a home in Colorado is more expensive than renting. Zillow named Denver the top housing market for 2016, but home prices haven’t been rising just in the state’s capital. Prices are up statewide because supply hasn’t kept up with demand. In fact, the supply of homes for sale in Colorado reached historic lows in May 2016, according to the Colorado Association of Realtors.

Minnesota

Renting vs. buying a home in Minnesota:

Monthly rent in Minnesota: $1,400

Monthly mortgage in Minnesota: $1,085

In a state where buying a home is less expensive than renting, home sales have been climbing. Sales increased 4.6 percent in May 2016 over the same period a year ago, according to the Minnesota Association of Realtors. However, the median sale price increased — up 7.9 percent — while the number of new listings dropped over the past year.

Wisconsin

Renting vs. buying a home in Wisconsin:

Monthly rent in Wisconsin: $1,200

Monthly mortgage in Wisconsin: $921

Madison is one of the top 25 most expensive rental markets in the U.S., according to the Zumper National Rent Report. And statewide, the median rent of $1,200 is $279 higher than the monthly mortgage on a home with the median list price of $177,000.

Buyers have been snapping up the state’s affordable houses, with existing home sales up 2.9 percent in May 2016 over May 2015, according to the Wisconsin Realtors Association.

Maryland

Renting vs. buying a home in Maryland:

Monthly rent in Maryland: $1,700

Monthly mortgage in Maryland: $1,446

One of the top 25 highest-priced rental markets is Baltimore, according to the Zumper report. However, it’s one of the most affordable markets to buy a home based on percentage of wages needed to purchase a house, according to the RealtyTrac Q2 2016 Home Affordability Index. Statewide, the monthly mortgage on a home with a median list price of $284,900 is $254 less than the median rent.

Missouri

Renting vs. buying a home in Missouri:

Monthly rent in Missouri: $950

Monthly mortgage in Missouri: $768

Missouri’s median rent of $950 is the lowest in the nation, along with Alabama. However, the monthly mortgage of $768 is even lower. And it seems buyers are taking advantage of affordable home prices in the state. Home sales rose 11.1 percent in May 2016 over May 2015, according to Missouri Realtors.

Tennessee

Renting vs. buying a home in Tennessee:

Monthly rent in Tennessee: $1,195

Monthly mortgage in Tennessee: $934

The median rent in Tennessee has jumped 8.6 percent from $1,100 in May 2015 to $1,195 in May 2016. Nashville is ranked as the 29th most expensive rental market in the U.S., according to the Zumper National Rent Report.

With the median rent in the state higher than the median monthly mortgage, buyers can get a better deal by owning a house.

Indiana

Renting vs. buying a home in Indiana:

Monthly rent in Indiana: $1,025

Monthly mortgage in Indiana: $745

With one of the lowest monthly mortgage costs on the list, buying a home is less expensive than renting in Indiana. Buyers have to act fast if they want to get a good deal, though. The inventory of new homes for sale has been decreasing, according to the Indiana Association of Realtors, and houses sell quickly once they’re on the market.

Massachusetts

Renting vs. buying a home in Massachusetts:

Monthly rent in Massachusetts: $2,500

Monthly mortgage in Massachusetts: $1,941

Although the median home list price is $389,000, homebuyers still come out ahead of renters due to high rents in the state. The nation’s fifth-most expensive rental market is in Boston, according to the Zumper National Rent Report. And the median statewide rent is more than $1,000 higher than the national median of $1,407, according to Zillow data

Arizona

Renting vs. buying a home in Arizona:

Monthly rent in Arizona: $1,250

Monthly mortgage in Arizona: $1,223

Seven of the top 100 highest-priced rental markets are in Arizona, according to the Zumper National Rent Report. Although the median rent statewide hasn’t risen over the past year, it’s still slightly higher than the median monthly mortgage, according to Zillow data.

Washington

Renting vs. buying a home in Washington:

Monthly rent in Washington: $1,650

Monthly mortgage in Washington: $1,515

Seattle is the 10th most expensive rental market in the U.S., according to the Zumper National Rent Report. The city also had the fifth-fastest increase in rent prices in the nation since June 2015, according to the July 2016 National Apartment List Rent Report. And Vancouver had the third-largest increase in rent prices.

To keep the cost of renting down in markets where prices are rising, Zillow’s Gudell recommends signing a two-year lease to avoid annual hikes.

Virginia

Renting vs. buying a home in Virginia:

Monthly rent in Virginia: $1,650

Monthly mortgage in Virginia: $1,465

Four of the nation’s top 75 highest-priced rental markets are in Virginia, according to Zumper. Renters are probably better off buying because the monthly mortgage on a home with a median list price of $289,990 is $185 less than the median rent of $1,650.

New Jersey

Renting vs. buying a home in New Jersey:

Monthly rent in New Jersey: $1,900

Monthly mortgage in New Jersey: $1,428

The median monthly rent in New Jersey pales in comparison to rents in its neighbor to the north, New York. But, it still tops the national median rent price of $1,407. And, rent is $472 higher than the monthly $1,428 mortgage on a house with a median list price of $299,900.

Michigan

Renting vs. buying a home in Michigan:

Monthly rent in Michigan: $1,000

Monthly mortgage in Michigan: $741

Michigan has the second-lowest monthly mortgage cost on the list, after Ohio. In fact, the Detroit metro area is one of the most affordable housing markets based on the percentage of wages needed to buy a median-priced home, according to RealtyTrac.

However, in some areas of the state — such as Grand Rapids — buyers have to act quickly to get the house they want. Supply is limited and demand is high, MLive Media Group reported in February.

North Carolina

Renting vs. buying a home in North Carolina:

Monthly rent in North Carolina: $1,175

Monthly mortgage in North Carolina: $1,089

Three North Carolina cities — Charlotte, Raleigh and Durham — rank among the 50 most expensive rental markets, according to the Zumper National Rent Report. Homebuyers in the state can get a better deal, though, with the median monthly mortgage cost $86 lower than the median monthly rent in the state. Plus, the National Association of Realtors lists Raleigh as one of the best metropolitan areas for aspiring millennial homebuyers.

Georgia

Renting vs. buying a home in Georgia:

Monthly rent in Georgia: $1,200

Monthly mortgage in Georgia: $1,029

Affordable prices make buying a home in Georgia less expensive than renting. However, competition among homebuyers is heating up as multiple offers are being made on houses at or above the asking price, according to the Georgia Association of Realtors.

Ohio

Renting vs. buying a home in Ohio:

Monthly rent in Ohio: $1,075

Monthly mortgage in Ohio: $700

Five Ohio cities are among the top 100 most expensive rental markets in the U.S., according to the Zumper National Rent Report. Statewide, the median rent has climbed 5.4 percent over the past year, from $1,019 in May 2015 to $1,075 in May 2016, according to Zillow data.

On the other hand, Ohio has the lowest monthly mortgage cost on our list. However, the average sale price of existing homes increased slightly — 3.1 percent — in May 2016 over May 2015, according to Ohio Association of Realtors.

Pennsylvania

Renting vs. buying a home in Pennsylvania:

Monthly rent in Pennsylvania: $1,395

Monthly mortgage in Pennsylvania: $934

Two Pennsylvania cities — Philadelphia and Pittsburgh — are among the top 30 highest-priced rental markets in the U.S., according to the Zumper National Rent Report. Statewide, though, the median rent hasn’t increased over the past year, according to Zillow data. Nonetheless, the median monthly rent is $461 higher than the monthly mortgage on a home with a median list price of $179,900 in Pennsylvania.

Illinois

Renting vs. buying a home in Illinois:

Monthly rent in Illinois: $1,600

Monthly mortgage in Illinois: $1,078

Chicago has one of the highest-priced rental markets, ranking 11th in the nation, according to the Zumper National Rent Report. Statewide, the median rent hasn’t risen over the past year, but it still tops the national median of $1,407, according to Zillow.

Compared with the state’s high median rent, a monthly mortgage on a home with a median list price of $209,500 is $522 lower.

New York

Renting vs. buying a home in New York:

Monthly rent in New York: $3,295

Monthly mortgage in New York: $1,660

With the average monthly rent in New York nearly twice the average monthly mortgage, it’s obvious why it’s cheaper to own a house in the Empire State. In fact, New York City is the second-most expensive rental market in the U.S., after San Francisco, according to the Zumper National Rent Report.

In a place where rents rise steadily, Zillow’s Gudell recommends getting a two-year lease to avoid rent increases if you’re going to be staying there for a while.

Florida

Renting vs. buying a home in Florida:

Monthly rent in Florida: $1,695

Monthly mortgage in Florida: $1,297

Rents have been rising in the Sunshine State — especially in South Florida where the population is growing and demand for rentals has increased, the Sun Sentinel reported in April.

In fact, Miami is the eighth-most expensive rental market in the U.S., according to the Zumper National Rent Report. More and more adults are living with roommates in Miami to offset high rents, Gudell said.

Texas

Renting vs. buying a home in Texas:

Monthly rent in Texas: $1,425

Monthly mortgage in Texas: $1,271

Two Texas cities — Dallas and Arlington — rank among the top 10 cities in the nation with the fastest-growing rents, according to the July 2016 National Apartment List Rent Report. Dallas is also one of the top 50 priciest rental markets, along with Austin, Plano, Houston and more, according to the Zumper National Rent Report.

On the other hand, Texas is favorable to homebuyers; the monthly mortgage is $154 cheaper than the monthly rent, according to this study’s findings.

California

Renting vs. buying a home in California:

Monthly rent in California: $2,400

Monthly mortgage in California: $2,221

Three of the top five most expensive rental markets in the U.S. are in California: San Francisco, Oakland and San Jose, according to the Zumper National Rent Report. And another three cities in the state, including Los Angeles and San Diego, are among the top 25 highest-priced rental markets.

Living with a roommate in California’s pricey rental markets can be a way to keep costs down — especially in cities like San Francisco and Los Angeles where it’s a growing trend, said Gudell of Zillow. However, to avoid paying high prices for housing, utilities, gas and more, consider moving to one of the best places for saving money.

SOURCE